“It’s very much a human effort here. The numbers don’t lie, but we also need to transform how people work, how they’re paying attention to those numbers.” -Vishy Venugopalan, Managing Partner, Weave Growth Partners

Silicon Valley Insights on Leveraging Data in the Midmarket

In this installment of Expert Insights Series, Blue Margin consultant Greg Brown hosts Vishy Venugopalan, Managing Partner at Weave Growth Partners. Vishy brings the Silicon Valley playbook to lower midmarket deals by melding his knowledge of tech startups, investing, and both descriptive and prescriptive analytics. The interview explores the ‘why’ behind private equity’s slower adoption of data driven practices, correlates data adoption practices to evolutionary biology, and discusses the human aspects of advancing data science.

Weave Growth Partners, founded in 2019, brings the data-driven growth mindset of venture capital into private equity. The firm makes businesses more customer-centric using technology and data science and prefers to invest in data-rich businesses with low fixed assets and high recurring revenues or repeat business. Prior to Weave Growth Partners, Vishy served as a venture capital investor at Citi Ventures, founded a Silicon Valley chatbot customer service platform, had investing stints at Silicon Valley venture capital firms, and worked in technology for Morgan Stanley. He has bachelor’s and master’s degrees in computer science and a bachelor’s degree in cognitive science from M.I.T and an MBA from Wharton.

Principal Interview Themes (jump to a section):

- Private Equity’s Late Adoption of Data-Driven Practices – an Explanation

- Data’s Evolutionary Process – an Analogy and Analysis

- The Cultural, Human Elements of Data Change – a Discussion and Advice

Private Equity’s Late Adoption of Data-Driven Practices

“I saw an immense opportunity to bring data into private equity and the rest of the economy… There is a change that is underway.” -Vishy Venugopalan, Managing Partner, Weave Growth Partners

Historically, private equity has been a late adopter of data science. Why? Vishy suggests it’s due to the macroeconomic shift and the nature of portfolio companies.

Macroeconomic Shift

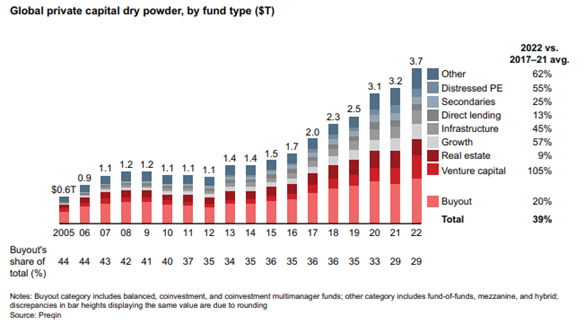

Frankly, most private equity groups (PEGs) haven’t needed to rely on data transformation as a value creator because this alternative asset class has flourished over the past two decades without it (Bain, 2023). From capital raised, to AUM, to dry powder, there’s been an overwhelming upward trajectory. Aside from the ’08 recession, this previous macroeconomic score has provided lower-hanging fruit, so optimizing and engineering balance sheets served as a viable value creation solution.

Dry powder’s meteoric ascent over the past 18 years:

(Source: bain_report_global-private-equity-report-2023.pdf)

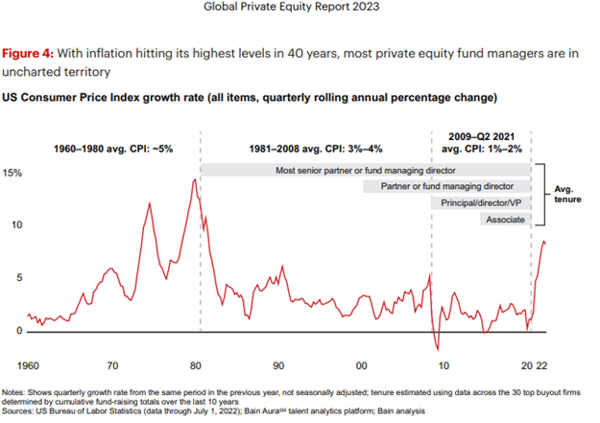

Contrast this ascent with 2023’s macroenvironment, particularly notable because of skyrocketing inflation:

This stubborn inflation, combined with the Reserve’s responding interest rate hikes and a healthy amount of uncertainty makes institutional investors more selective with their private market capital allocation. With the lack of free-flowing capital and products, operational leaders want more transparency from their portfolios and, in contrast to the previous two decades, are more inclined to examine data and reporting initiatives as a value creation strategy as well as a means for gaining better oversight and cost control.

Vishy comments that PEGs have historically appreciated financial metrics, but today’s economy has amplified the value of operational metrics as well. Challenging times add an imperative to operationally improve a business, which, according to Vishy, returns full circle to PE’s 1980s origins, back in 1979 when the CPI was a record-high 13.3% (Jackman, 1990).

The Nature of PE-Backed Companies

In addition to shifting macroeconomics, Vishy says another reason private equity entered the data science game late is due to its very nature – PEGs tend to invest in successfully performing companies.

Private equity backed companies are ‘default alive’ and looking to grow an existing business, while venture capital backed companies, having limited runway, are ‘default dead’ unless they create value out of nothing. You’ll see VC companies hungrily investing in data-driven practices from day one, where portfolio companies are slow-moving giants with established processes, layers of bureaucracy, and a cash cushion.

As an analogy, if we likened Venture Capital to an aircraft carrier, then Private Equity would be an airport with a full runway strip. On average, VC firms hope to exit three years after making their investment, while private equity firms maintain average holding periods of five to seven years (Forbes Finance, 2023). Vishy says that “VC companies have fairly aggressive growth targets with a limited runway,” whereas private equity backed companies are already profitable, and their longer runways have historically minimized the importance of data transformation.

Data’s Evolutionary Process

In both data science and biology, “There is a general evolution in responding to stimuli. There is also learning and memory, a much better awareness of where the organism is, and an awareness of what it needs to do, such as planning. These types of functions are higher cognitive functions.” -Vishy Venugopalan, Managing Partner, Weave Growth Partners

Vishy uses biological evolution as an analogy for the evolution of data science within an organization, where descriptive and prescriptive analytics demonstrate organizational understanding and higher cognitive function. This evolution helps organizations be proactive in planning and start incorporating some automated tasks. The next (and current) evolution of data science is what Vishy terms ‘API-ification’ – weaving automation into core business functions.

“The main ingredient I would highlight, in addition to data and analytics, is automation… If you set up automation correctly, it can help orchestrate the core business processes within your organization.”

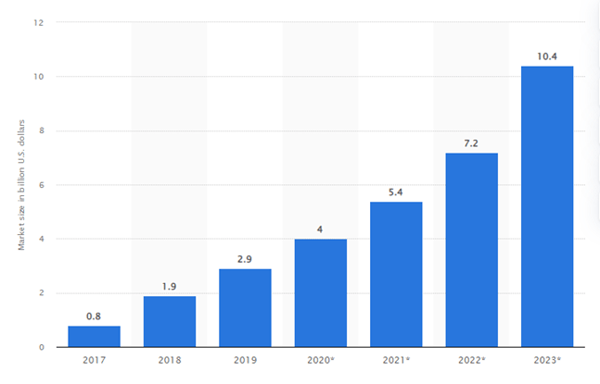

Data leaders are starting small and working towards the automation of core business processes, or “robotic process automation” (RPA). RPA is set to reach $10.4B in worldwide market value this year (Statista, 2022):

(Source: Global robotic process automation market 2023 | Statista)

Despite market growth, RPA cannot (yet) take over processes from start to finish. Right now, humans must determine which process components to automate and also ensure the correct integration, as RPA is still brittle. The next level of evolutionary development is subprocess self-automation, where RPA will only need human intervention for edge cases.

The Cultural, Human Elements of Data Change

“It is not an insignificant amount of leadership that needs to be exercised to lead the people to change their behavior over the long term and make it more data driven.” -Vishy Venugopalan, Managing Partner, Weave Growth Partners

Effective leaders recognize data transformation requires changing the way people work. It’s a complex progression; what starts as simple data point becomes information that needs interpretation and eventually a decision that needs enacted. Becoming data-driven requires leaders to identify where behavioral change is needed and incorporate change management for lasting effects. (Learn more about the change management side of data transformation on a recent EIS interview with an organizational psychologist: full title here, linked.)

For those looking for concrete steps to evolve their company’s data strategy, Vishy recommends the following:

- Senior leaders should take the lead and model data-driven decision making for their direct reports and broadly within the company.

- Don’t boil the ocean. Start with a medium-sized project scope, identify success indicators, and demonstrate wins.

- Document key processes, paying attention to the handoff between humans and algorithms.

- Establish foundational data analytics before you think about automation. Use external experts if needed.

- Secure buy in all the way to the top, including your board and C-suite.

- Lead “transformationally”, not transactionally. Encourage people to share ideas, make data-driven decisions, and challenge assumptions.

Connect with Vishy and Weave Growth Partners

Interested in connecting with Vishy? You can find him through Weave Growth Partners or on LinkedIn. His team is always glad to talk with owners and executives who want to use technology and data to grow their business.

Blue Margin helps PE and mid-market companies develop BI infrastructure and quickly convert their data into automated dashboards, the most efficient way to create company-wide accountability to the growth plan. We call it The Dashboard Effect, the title of our book and podcast. Our mission is to accelerate your value creation plan.