“If you can create and develop those systems, which is difficult to do in a short time period, but if you can do it, create that data visibility, you’re rewarded handsomely when it comes to exit.” – John Parent

This episode of Expert Insights Series, hosted by Blue Margin Co-Founder Jon Thompson, features investment professional John Parent of Industrial Growth Partners (IGP). John has a background in investment banking, has been with IGP for seven years, and serves or has served as a director of APCT, Redco Group, Royal Power Solutions, and SPL.

For the past 25 years, IGP has specialized in the industrial sector, focusing on engineered products and industrial services. They have raised over $3.4 billion, just closed their sixth fund, and have invested in over 40 platform companies. Their mission is straightforward: to invest in and build global, market-leading industrial companies.

Watch the full interview, listen to the podcast, or read the interview highlights below.

Principal Themes:

- During deal sourcing and diligence, it’s critical to assess the acquisition target’s potential to leverage data as a value driver.

- During the hold period, use data visibility to enable operational efficiency and reduce overhead.

- At exit, use detailed forecasting supported by granular data to increase valuations and buyer confidence.

- In an increasingly competitive PE landscape, win with specialization.

Leading PE Firms Use Data Analytics During Deal Sourcing and Diligence

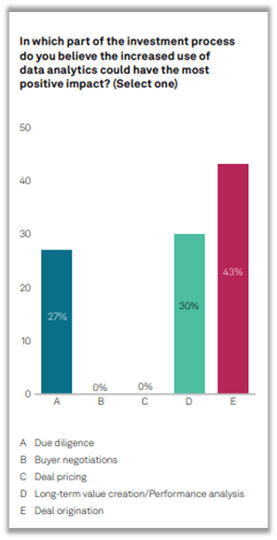

S&P Global recently published their 2022 Data Analytics for PE Report, surveying 30 senior executives from U.S. PE firms with a minimum of $2bn AUM. The report found that during the investment life cycle, the deal origination and diligence stages most benefit from data analytics. “A key point is that data analytics applications for deal origination and performance analysis already exist and as seen earlier, a small number of early adopters are already blazing a trail. For firms that do not currently possess these capabilities, adoption is less a question of innovation and more a matter of catching up with competitors” (S&P Global, 2022).

PE firms and their advisors are using data that is stored on sellers’ systems to go beyond the financials and investigate the synergies in data behind the financials (Association for Corporate Growth, 2021).

Using data for diligence in this way is an approach IGP embraces. According to John, acquiring a business with underdeveloped data capabilities comes with opportunity and risk. While these businesses may be adept at day-to-day operations, their growth is limited by poor data visibility. Lacking insight into untapped growth opportunities across potentially thousands of customers and hundreds of thousands of SKUs, investors have an opportunity to pay attractive prices for unfurrowed ground, under which lies the “golden nuggets” buried in the data. At the same time, John points out that buying homegrown companies who lack a handle on their data also comes with risk. Ramping up their data practice can take as long as 18 months, increasing the risk of falling behind the market. (In an earlier interview, Tecum Capital discusses this risk in detail.)

“If there isn’t great control of their data, their systems, their processes, their key metrics – that can create some risks, such as operational hygiene. (Investors) are exposed because their competitors are doing certain things and they are not, and it makes a buyer question the longevity of the company.” – John Parent

Why Private Equity Must Prioritize Data Visibility During the Hold Period

Consider the view from your car. Would you rather drive looking through your front windshield or through your rear-view mirror? When decisions must be made, and the road ahead is rough, you need to be able to see ahead to avoid potholes. Data visibility enables portco executives to manage their companies proactively and with intention, rather than reacting after the fact.

Because IGP considers companies with underdeveloped data capabilities to be diamonds in the rough, during diligence they ask, “What systems and capabilities does this company have today? And what do we want it to look like going forward?” John tells the story of an IGP investment that had no yearly interim financials. When IGP created a simple monthly reporting package with basic financials, operational, financial, and sales metrics all rose. In essence, IGP monetized the data. We often hear similar real-world stories at Blue Margin from executives who for the first time see operations become more efficient by simply surfacing the right metrics to the right people. And it’s not just the stories we hear; NewVantage reports in their 2022 Data and AI Leadership Executive Survey that 92.1% of surveyed companies report strong returns on their data and AI investments (NewVantage, 2022).

According to S&P Global, IGP’s data strategy aligns with best practices. Their 2022 report finds that the most important attributes of PE firms’ data analytics processes are automated reports and high-quality data visualizations. Furthermore, 90% of mid-sized firms surveyed rely on an outside vendor for data management and analytics. (S&P Global, 2022)

Private Equity Uses Detailed Forecasting Data for a Successful Exit

“Every buyer is skeptical of the future. There is always an element of ‘Hey, prove it to me’. The amount of granularity and specificity that you can point to as a seller increases the confidence that a buyer has in underwriting that forecast.” -John Parent

Data visibility makes it possible to provide detailed forecasting that boosts buyer confidence, translating to higher valuations. PE firms with these capabilities can quantify trends on key performance metrics identified during diligence and tracked throughout the hold. With this data in hand, they can tell an empirical growth story and substantiate the foundation for future growth. The more granular the data buyers can drill into, the more confident the underwriting.

Adam Coffey, serial PE-backed CEO, consultant, and #1 bestselling author of the Exit Strategy Playbook (Coffey, 2022) confirms the real-world observation that strong data forecasting correlates to higher valuation levels. In his experience buying and selling 58 companies, those with good visibility into data and analytics are perceived as better companies, and trade at the higher end of their multiples range.

John Parent puts it like this, “Saying, ‘We grew 10% the last three years, and we are going to do that for the next six years,’ doesn’t give a buyer the same comfort level as saying, ‘Here are our exact customers and our exact platforms that we have been tracking historically. Here was our forecast five years ago, and we were spot-on based on production builds. Here are the platforms we are on, and we’re going to do the exact same thing for the next five years. So, Mr. Buyer, you should pay us for our entire forecast, you shouldn’t be haircutting it, discounting it, or risk-adjusting it.’”

Overcoming Private Equity’s Increasing Competition and Complexity with Specialization

Fading are the days when PE firms could rely solely on multiples arbitrage. Deal theses by necessity are increasing in complexity as more capital enters the market and valuations rise. Competition is fierce, particularly in the U.S. Global PE transactions totaled US$2.1tn in 2021, and American firms represented 62% of that deal value. 100% of S&P Global PE Survey respondents agreed that increased competition for assets drives their firms to reassess the use of data and technology (S&P Global, 2022). For survival, firms must make better and faster decisions.

“We have to be swift. There are quite a few challenges in the modern investment environment, so we employ data analytics to weigh up the available options,” writes one respondent, a managing director with over US$26bn AUM (S&P Global, 2022).

In addition to harnessing the power of data, more firms are creating advantage by planting a flag in specific sectors, carving a niche they can own to align with their strongest areas of expertise. IGP was an early trendsetter in specialization. For the past 25 years, they have invested solely in manufacturing and industrials. This is particularly remarkable considering the PE industry only fully received its wings in 1978, when the federal government lowered capital gains tax and loosened ERISA regulations (InvestmentU, 2022). IGP’s focus makes it easier to stay ahead of the field, creating alpha and outsized returns. This strategic, singular, long-term focus has produced a solid foundation of expertise that helps IGP weather market volatility and stay in the upper quartile of an increasingly crowded industry.

Connect with John Parent and IGP

If you would like to hear more from John, you can find him on LinkedIn or at Industrial Growth Partners.

About Blue Margin, Inc.

Blue Margin helps PE and mid-market companies quickly convert data into automated dashboards, the most efficient way to create company-wide accountability to the growth plan. We call it The Dashboard Effect, the title of our book and podcast. Our mission is to deliver breakthroughs early and often.