“Companies that are more sophisticated from a data perspective are also more valuable. They trade for a higher multiple. They probably have better growth trajectories than businesses that do not because they have a very cohesive set of operating parameters they're following.” - Adam Coffey, 3-time CEO of PE-backed companies and #1 bestselling author of The Private Equity Playbook and The Exit Strategy Playbook

Value of Data Diligence

Data diligence offers private equity firms better insight into their target acquisition’s current use and potential use of data for growth and value creation. Diligence identifies the low-hanging fruit to immediately improve data visibility (to increase accountability to the growth plan and identify constraints and opportunities in finance and operations) and tactical steps to close the “data gap” (reference: 2022 NewVantage Executive Survey which found 91.7% of organizations report increasing data investment, while only 19.3% have established a data culture.)

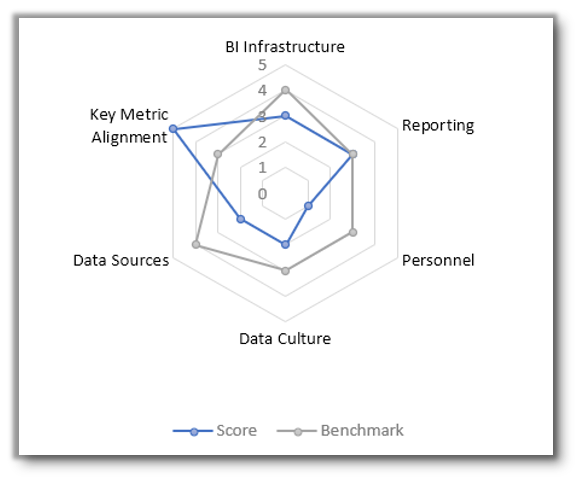

Data diligence should include both a technical and strategic lens. In other words, proliferation of reports does not necessarily indicate effective use of data. Conversely, where strategic alignment on data is strong, a weak BI infrastructure will limit potential gains. An effective data diligence engagement should evaluate both elements against benchmarks:

Figure 1- example benchmark assessment

Technical Evaluation

Technical considerations of a data diligence audit include a target’s existing infrastructure, data sources, and reporting assets.

- BI Infrastructure

- Does the target have a reliable and efficient way to gather, store, and report from company data?

- How are reports distributed? Are they centrally available, or isolated to emails and individual PCs?

- Data Sources

- Is the data valid, complete, and trustworthy?

- Is data from various sources integrated for a holistic view of the business?

- Reporting Assets

- What existing reports are in use?

- How well are they adopted?

- Do they create a sense of team and accountability by role to the metrics that advance the value creation plan?

Strategic Evaluation

Strategic considerations include stakeholder alignment around key metrics, investment into BI skills and tools, and the maturity of the data culture.

- Key Metric Alignment

- Does the company have a firm grasp (and concrete definitions) on which value-drivers most support the value creation plan?

- Are key stakeholders aligned on the company’s key metrics and which roles are accountable to deliver on them?

- Does the company have reliable forecasting (e.g., projecting backlog and sales funnel) to address upcoming shortfalls?

- BI Personnel

- Does the company have the appropriate skillsets and capacity for organizing data and generating reports that get adopted and improve outcomes?

- Is there a master data roadmap, and does it align with and enable the growth plan?

- Data Culture

- Does the executive team understand the potential of data to drive prioritization, employee engagement, productivity, and cost control?

- Is critical data centrally available and accessible? Is there transparency?

- Does data drive decision-making?

Data diligence focused on leveraging data to increase value can create a compelling case during sign-to-close, quantifying the near- and long-term opportunities to capitalize on a company’s assets, and the cost, time, and resources needed to close the data gap.

Blue Margin partners with private equity firms to provide an assessment and rubric for the time, cost, and resources needed to address data gaps and poise the company for maximum valuation at exit, with minimal disruption to stakeholder schedules.