In this Expert Insights Series episode, Blue Margin co-founder and Chief Strategy Officer Jon Thompson hosts Paul Stansik, Operating Partner at ParkerGale Capital. Founded in 2014, ParkerGale exclusively invests in profitable North American technology companies, assuming majority ownership. At the firm, Paul works with management teams to drive organic growth through improved sales, marketing, and leadership effectiveness.

Prior to joining the firm in 2019, Paul served as a senior manager at Bain & Company in private equity, and VP of Sales at financial research firm ITG. With an MBA from Wharton, Paul is a prolific business writer and popular expert guest. Paul’s writing and ParkerGale’s podcast, PE Funcast, are both linked in resources.

“For most businesses and founder-owned businesses, keeping track of KPIs and metrics – just measuring performance – is a new thing. It’s extra work and teams need help doing it. I think it’s our job to help them do that work, to help build simple, consistent reporting. (Data) gives us as investors visibility into what’s going on, how the business is performing and what needs fixing. But it’s also something the management team can use to have a better conversation every week with the team, without us in the room. It’s one of the most foundational elements of support we provide.” – Paul Stansik, Operating Partner, ParkerGale Capital

Principal Interview Themes:

- How to Use Vulnerability to Build Trust and Improve Team Performance

- Why You Should Show Less Data, More Often

- How to Improve Your Company with Data-Driven Dialogue and a Weekly Sales Metric Playbook

How to Use Vulnerability to Build Trust and Improve Team Performance

“In that moment of truth, when someone is deciding whether it makes sense to give a protective answer verses a vulnerable answer – if you haven’t set that foundation where people know that it’s safe – you’re going to have a really hard time having a different (data-based) conversation about your business.” – Paul Stansik, Operating Partner at ParkerGale Capital

The benefits of reporting and analytics are widely known – so what is it that keeps management teams from wanting to drive their business with data? Paul explains two roadblocks—biological and organizational – that keep founders and management teams from harnessing the power of data.

Biologically, we crave acceptance – we are not wired to be vulnerable in front of others. Paul says, “When you think about opening up your part of a business or a team, and exposing the warts, flaws, mistakes, and things that are going wrong – that is a scary thing.” And organizationally, particularly because of increased remote work over the past few years, most teams have not built sufficient levels of team trust to support honest, objective conversations based on data. Trust removes these biological and organizational roadblocks to using data well, and it helps management teams perform at higher levels.

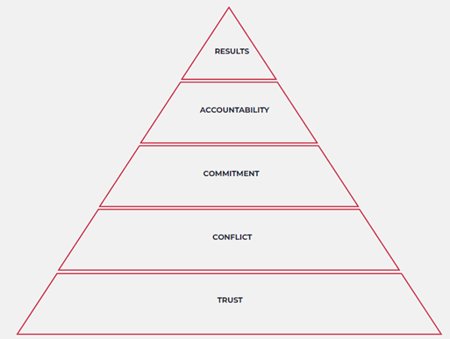

In Five Dysfunctions of a Team, best-selling author and speaker Patrick Lencioni points to absence of trust as the foundational dysfunction. Fear of vulnerability prevents trust from building.

(Source: Teamwork 5 Dysfunctions | The Table Group)

“It’s not just saying to folks – ‘Hey, by the way, it’s safe to be real.’ – but it’s getting in the practice over and over and over.” – Jon Thompson, Co-Founder, Blue Margin

To build trust, leaders should take opportunities to model vulnerability and transparency in difficult conversations and affirm their teammates/employees who do so. Paul says, “If they don’t get recognition when they make that choice, we’re going to slide back into this more protective, less data-driven, less honest conversation about the business.”

Why You Should Show Less Data, More Often

“If you want someone to have a different conversation about how sales and marketing is going, you should be compressing your operating cycles and allowing them to practice having the conversation as frequently as possible.” – Paul Stansik, Operating Partner, ParkerGale Capital

To explain why compressing operating cycles is important, Paul references 1972 Olympic gold medalist wrestler Dan Gable, who said, “If it is important, do it every day. If not important, don’t do it at all.” Frequency trumps intensity, so if leaders want to see business improvement, they should provide more frequent feedback.

Adopting this mentality, ParkerGale takes a “less data, more often” approach in monitoring portfolio companies’ performance. They do this through weekly transparent, metrics-based conversations where Paul’s sales and marketing teams quantitatively evaluate weekly performance based on how well they are converting pipeline to revenue and creating new opportunities. These meetings satiate the investors’ need to monitor trends and provide an opportunity for honest dialogue that helps portfolio operating teams become more comfortable using data to evaluate and improve performance.

How to Improve Your Business with Data-Driven Dialogue

“In my world of growth, sales, and marketing it all starts with answering questions. This month, we’re finally publishing a handbook that we use inside the portfolio. We’re open sourcing the questions that we ask our companies to answer every week and every month, and we share the actual format of the reporting that we use to honestly answer those questions.” – Paul Stansik, Operating Partner, ParkerGale Capital

While Paul doesn’t apply a dogmatic top-line growth playbook across portfolio companies, he does use a set of guiding principles and questions to create buy in and standardize future dialogue around business improvement.

Without stakeholder buy-in, you run the risk of the Semmelweis Reflex. Termed after 19th century physician, Ignaz Semmelweis, who pioneered hand hygiene but was ignored and rejected by his peers (Gupta et. al., 2020), the reflex describes a tendency to reject new evidence or knowledge that contradicts established beliefs or norms and helps illustrate the importance of involving your team in the discovery phase of change management.

Accordingly, Paul begins this process by asking the management team and the investors what questions they need answered on a regular basis in order to create helpful reports. These reports enable investors and management teams to actively participate in the change process and engage in effective dialogue. (Learn more about creating buy-in and leading change management via our Expert Insight Series interview with organizational psychologist Dain Johnson.)

Download ParkerGale’s Weekly Sales Metric Playbook

“We subscribe to the Dolly Parton school of operational philosophy. She’s got this great quote, which goes, ‘You should find out who you are and then do it on purpose.’ And that’s what we do on our operations team – reflecting, talking to the management team, and ultimately trying to figure out what does this business already look like when it’s operating at its best and then pulling the levers that we can pull so that it happens a little more consistently.” – Paul Stansik, Operating Partner, ParkerGale Capital

If you would like to find out what your business looks like when it is operating ideally and make that happen more consistently, Paul has open-sourced his templated approach to sales metrics. You can find the resource here: The Weekly Sales Metrics Playbook.

Connect with Paul

Connect with Paul via ParkerGale’s website or LinkedIn.

Interested in reading Paul’s articles about sales, marketing, growth, and leadership? Read his well-packaged, witty wisdom on Medium.

Blue Margin – BI Advisors for PE and the Middle Market

Blue Margin increases enterprise value for PE-backed, mid-market companies by building and managing their data platforms. Our strategy, proven with over 250 companies to-date, expands multiples through data transformation, as presented in our book, The Dashboard Effect. Download your copy here and subscribe to our podcast for weekly insights.