“Data monetization is generating new, measurable value streams from available data assets.” -Doug Laney, Data Juice

As an operating partner, you know that data is valuable. Your central goal is maximizing ROI by successfully executing the value creation plan – and you need KPIs to execute that plan with your management team and detail it for the board. But often, data has gaps, making it difficult to surface the critical information you need to do your job and keep everyone aligned. You likely have new data analytics strategies in your pocket, hypothesizing how better data analytics will improve your portfolio companies’ valuations through organic growth, better decision making, and operational and organizational efficiencies.

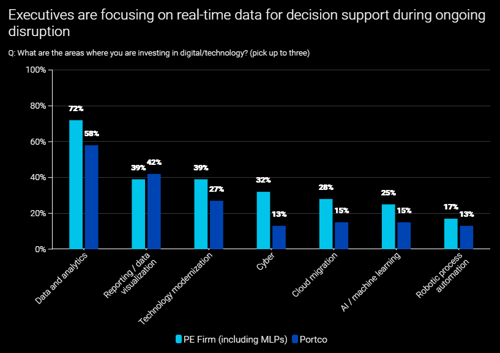

(Source: Eighth Annual PE Leadership Survey | AlixPartners)

You’re right, and you’re not alone. AlixPartner’s 2023 Private Equity (PE) Leadership Survey finds that data – analytics, reporting, and visualization – comprises the top two tech investment areas for modern PE firms and their management teams:

Data Strategy Needs Data-Driven Execution

In their 2022 Data and AI Leadership Executive Survey, NewVantage Partners surveyed 94 Fortune 1000 C-Suite leaders. Their survey found that while 64.3% of organizations focused on growth and innovation data initiatives, only 26.5% of those same firms had created a data-driven organization (NewVantage Partners, 2023).

If PE firms and portfolio company leaders both favor investments in data, why are companies struggling to become data-driven?

We call it “the gap”. A gap between data strategy and execution.

In our opinion, a key to overcoming this gap is calculating and clearly articulating the ROI of data projects (e.g., quantifiable increases in sales revenue or decreases in operating costs). Of course, this process takes the most valuable asset – time – so many operating partners would appreciate a more streamlined process to assess and communicate the potential value (or monetization) of data projects to their portfolio executives.

We help operating partners remove the gap between data strategy and execution. Aside from our managed data services, the best way we can help remove this gap for your firm is by streamlining the process of data monetization. To do so, we’ll briefly outline data monetization business theory, and then provide a downloadable guide that walks your firm through the assessment process.

What is Data Monetization?

Monetizing your data means turning it into measurable value by using it effectively (Algmin, 2023). To calculate the value of data projects, leaders should compare the business outcomes before and after using data as an asset. They should also identify and quantify the potential ROI of each project based on value drivers. At Blue Margin, we think about value drivers within these three categories – increasing revenue, decreasing cost, and managing risk – as we evaluate and prioritize data projects.