"BI provides real-time visibility into current signals, so leaders can make proactive changes rather than reactionary adjustments. Start with quick-hitting dashboards that surface to your team the metrics most critical to stepping forth, while others hide in their shells."

With the ongoing barrage of volatile economic news, business leaders might find themselves adopting a turtle-like defensive position. When faced with adversity, contraction is a natural response. Scenario planning and cash management take center stage.

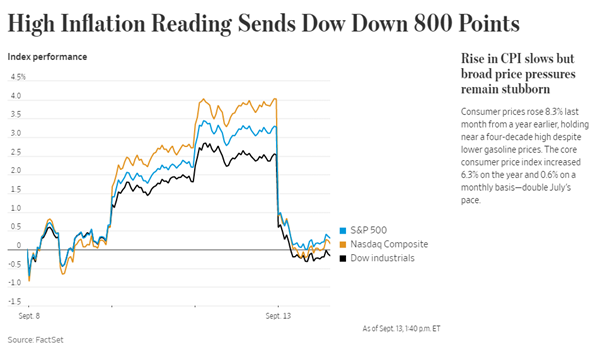

And make no mistake – the adversity is real. The U.S. economy is still recovering from the pandemic’s impact, evidenced by an ongoing labor shortage and supply chain gaps. Core CPI rose to an annualized rate of 6.3% this month (BLS, 2022). With inflation remaining historically high, the harbinger of an upcoming recession hangs overhead in the darkening clouds of central bank rate hikes. Even as the market plunged this week (MarketWatch, 2022), warnings were issued that the S&P 500 could dive another 26% (Mohamed, 2022).

At the same time, challenging market conditions provide business leaders with an opportunity to distance themselves from the rest of the pack. History shows that the market favors the brave. Companies that seize the opportunities of market disruptions historically outperform those who do not (Heinrich et al, 2022), whereas a contractionary response leads to median company performance (Birshan et al, 2022). This research is balanced by the counter-observation that an exclusively expansionary approach can lead to catastrophic flops.

So, there must be prudence and balance. While defensive actions are necessary at times, we would suggest that leaders simultaneously adopt an opportunistic, offensive stance, a hearty “Aaaarg!” in the face of the storm.

Remind yourself that courage is not simply a virtue; it’s a business requirement.

Accepting that venturing courage is required to thrive in both the ebbs and flows, a leader might ask – What does reasonable courage look like? McKinsey & Company’s quarterly whitepaper says, “The best leaders and companies are ambidextrous: prudent about managing the downside while aggressively pursuing the upside” (Birshan et al, 2022). So why do most opt for shelter? Because when the line between prudence and pursuit is unclear, the safer choice wins. Data insights is the key to overcoming the non-choice between playing it safe and rolling the dice. Clarity around the performance numbers and measurable risk enables leaders to be bold rather than reckless, to make decisions, commit, and execute.

(For additional insights, read our interview with Jill Belconis, who led Shelter Mortgage, even in the midst of a recession, to an average of 20% growth annually.)

Data Creates a Tactical Advantage

As a data analytics consultancy, we have a front row seat for watching how a deeper understanding of your data (compared to your competitors) creates tactical advantage. Ask yourself the following questions posed by McKinsey & Company (Birshan et al, 2022):

- “Do we have full visibility into our supply chain, including third- and fourth-tier suppliers, the risks embedded in those relationships, and our options for strengthening the supply chain’s resilience through dual-sourcing and in-region manufacturing?

- Are we evaluating our portfolio at a granular enough level and fast enough pace to see region- or segment-specific headwinds and tailwinds that a higher-level view may obscure?

- How intimate an understanding do we have of our customers and end consumers, and are we able to gather changes in consumer sentiment rapidly and continually?

- Do we have a mechanism to pick up signals from across the organization, including geographic leaders and commercial financial planning and analysis, on a regular basis—or, better still, in real time—and distill them quickly into options the organization can act on?

- Have we built digital and analytics capabilities across the enterprise—from data collection and governance to machine learning—that yield cutting-edge proprietary insight?

- Are our scenario analyses and risk identification sufficiently creative or do we risk falling prey to a failure of imagination about what could happen?”

If you find yourself answering “no” to most of these questions, it may be the season to invest in business intelligence. BI provides real-time visibility into current signals, so leaders can make proactive changes rather than reactionary adjustments. Start with quick-hitting dashboards that surface to your team the metrics most critical to stepping forth, while others hide in their shells.